Caring for Others

Being a caregiver can be overwhelming, and no one should have to do it alone. At Iona, we offer a variety of personalized social, financial, memory, and care programs for older adults that provide caregivers with support and much-needed respite time.

Explore Iona’s programs to find community, support, and resources as you care for others.

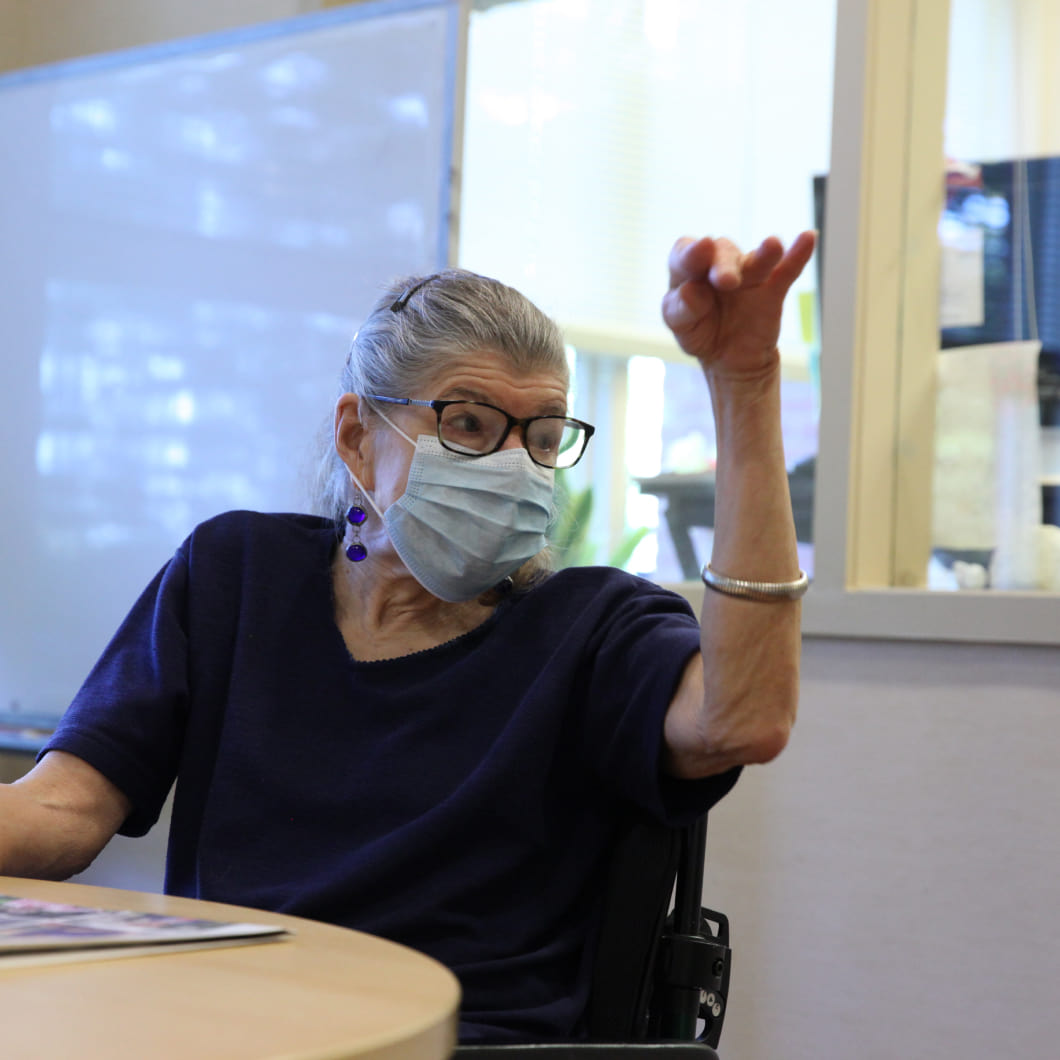

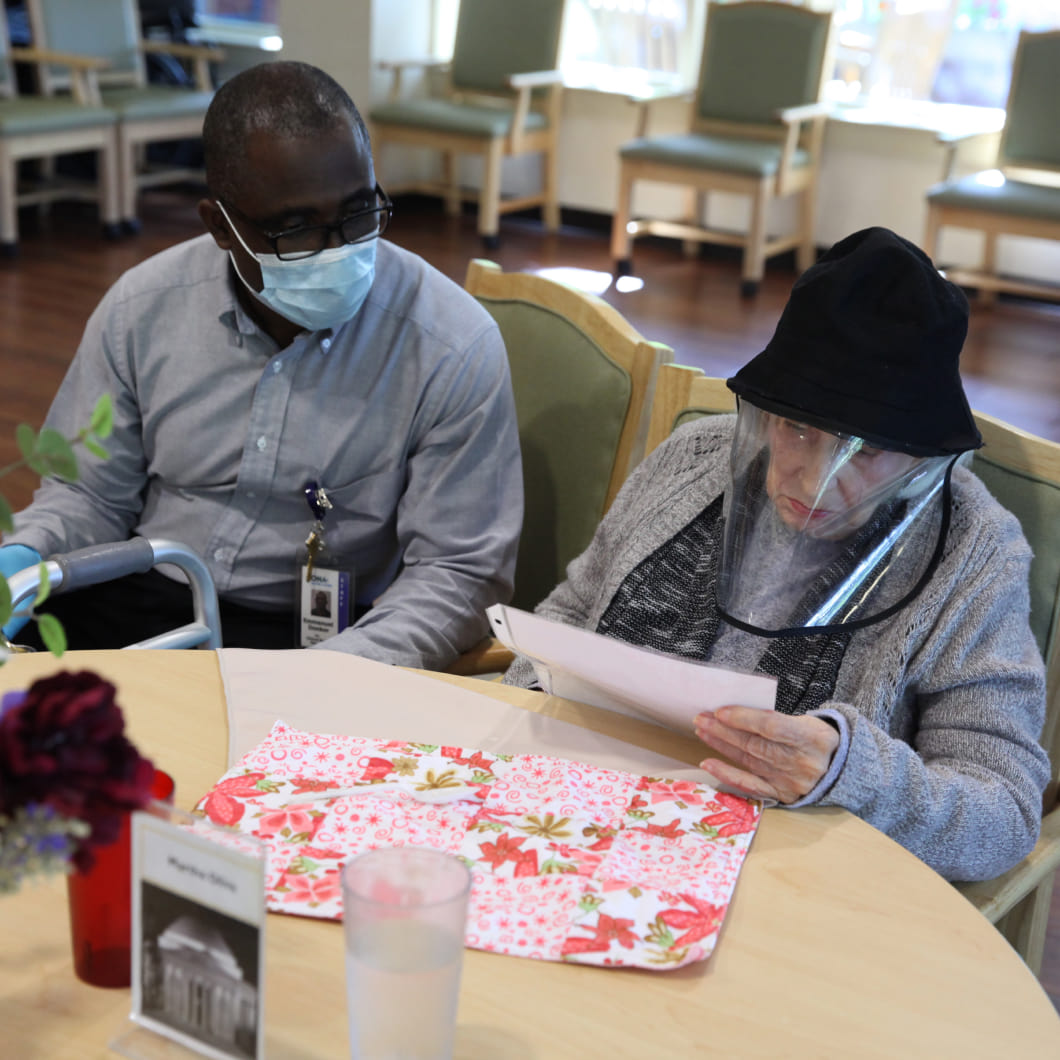

- Adult Day HealthTwo centers offer individualized therapeutic, social, and health services for people with memory loss and disabilities.Go to page

- Dementia NavigatorsEducation, referrals, assessments, and case management for older adults and families facing a diagnosis of dementia.Go to page

- Iona Care ManagementExpert support for older adults, caregivers, and families seeking assistance with aging and caregiving challenges.Go to page

- Money ManagementIntensive assistance for older adults with memory loss to manage personal finances and prevent exploitation.Go to page